Our Journey Through Time

In November 2011, DCI Microfinance Limited was incorporated, inspired by a vision to become a premier financial services provider in the eyes of employees, customers, shareholders and stakeholders

The dream took shape in April 2012, when DCI received its provisional license from the Bank of Ghana to operate as a deposit-taking microfinance company.

By October 2012, DCI obtained its final license, marking the official beginning of operations. From the start, the goal was clear — to go miles beyond the extra in serving clients.

The early years were marked by growth, innovation, and a deepening commitment to SMEs and individual entrepreneurs.

DCI introduced tailored financial products such as Invoice Discounting, Contract/LPO Financing, Investment and Savings Products designed to meet the diverse needs of clients.

With steady growth came expansion, from the Head Office at Asylum Down and Abossey Okai branch, DCI extended its presence to Spintex and Tema, bringing convenient financial services closer to customers.

DCI was proudly named No. 38 on the prestigious Ghana Club 100 list, a testament to its growth, stability, and service excellence.

Driven by customer feedback and a commitment to speed and simplicity, DCI introduced the Diamond Quick-Pay Loan, a product that offered government and corporate workers fast, stress-free access to credit.

During the Bank of Ghana’s major banking sector clean-up, which led to the closure of many institutions, DCI stood firm as a licensed and compliant company.

This resilience reaffirmed the company’s solid governance, financial discipline, and commitment to ethical business practices.

While others fell, DCI thrived — a true testament to its sound management and enduring customer trust.

As DCI marked its

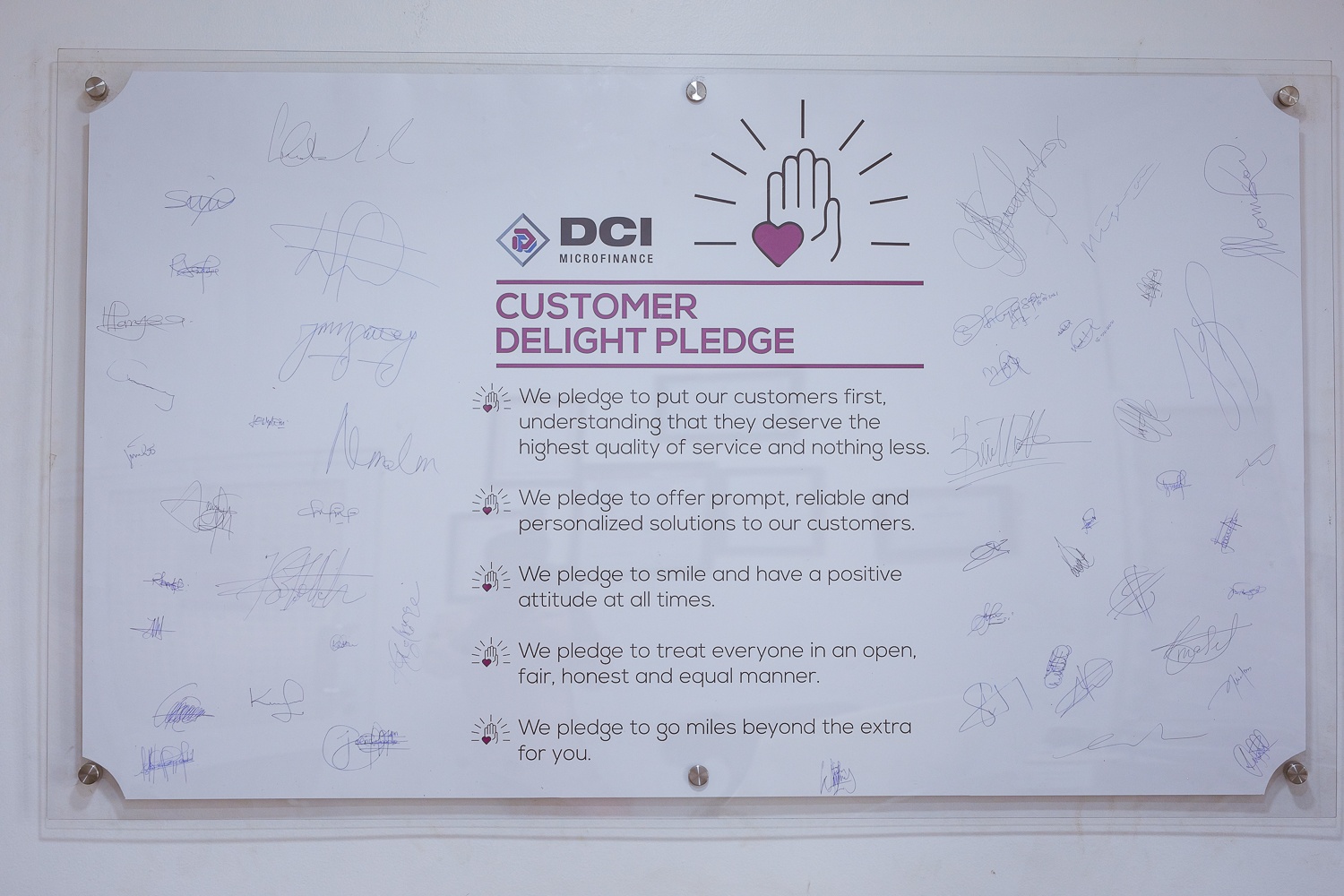

It was more than a campaign; it was a promise to listen, serve better, and deliver value that delights.

This year focused on deepening systems, strengthening relationships, and preparing for the next phase of digital and cultural transformation.

Internally, DCI began cultivating a values-driven culture that would soon define its identity.

In response to the devastating floods in Mepe, DCI extended a hand of love and solidarity through donations to affected victims, reaffirming its belief that business must serve humanity. It was a year that reminded us that true success lies not only in profit, but in purpose.

DCI launched PROGECT DIAMOND, an internal cultural campaign designed to deepen staff understanding of the company’s seven core values: Professionalism, Resilience, Openness, Godliness, Excellence, Curiosity, and Temperance.

The campaign ignited a renewed sense of pride and belonging among staff.

That same year, DCI staff also took to the streets to share meals as part of the annual “Diamond Charity Project”, spreading kindness and demonstrating the heart behind the brand.

DCI continues to evolve, combining technology with a human touch. DCI remains committed to empowering dreams, growing businesses, and inspiring trust.

Our story continues - always miles beyond the extra.

Our Expertise

The management team at DCI Microfinance boasts over 20 years of combined experience in the banking industry, both within Ghana and internationally. This extensive background informs our approach to providing financial services tailored to the specific needs of Small and Medium Scale Enterprises (SMEs).

Our familiarity with local business practices, culture, politics, and the legal climate offers us a competitive edge in delivering relevant and insightful support to our clients. This deep understanding allows us to create financial solutions that truly address the unique challenges faced by businesses in Ghana.

Our Financial Products and Services

DCI Microfinance offers a comprehensive range of financial products and services, including:

- Contract financing

- Local Purchase Order (LPO) financing

- Invoice discounting

- Certificate discounting

- Loans

- Investments

- Fixed deposits

These offerings are designed to provide short-term working capital solutions to individuals and businesses, particularly SMEs.

Leadership

The company's leadership is exemplified by its Managing Director and Chief Executive Officer, Selasie Woanyah. In interviews, Mr. Woanyah has shared insights into his journey into the financial sector, highlighting initial uncertainties in choosing a career path before ultimately finding his niche in finance.

Corporate Social Responsibility

Beyond our core financial services, DCI Microfinance demonstrates a strong commitment to corporate social responsibility:

Healthcare Support

In August 2023, we made a generous donation to the Princess Marie Louise Children's Hospital, providing essential medical supplies and hygiene products. This initiative aimed to enhance the hospital experience for young patients and alleviate the burden on the hospital's resources. Additionally, our staff covered the medical bills of several patients in dire financial need.

Disaster Relief

In October 2023, following the Akosombo Dam spillage that led to severe flooding in Mepe, North Tongu District, we donated 1,000 mosquito nets to the displaced flood victims. A delegation from the company, including Divisional Heads Vincentia Malm and Reginald Grantson Neequaye, personally delivered the nets and expressed their sympathies to the affected community. The donation was well-received by local leaders and government representatives, including Hon. Samuel Okudzeto Ablakwa, Member of Parliament for the North Tongu Constituency.

DCI Microfinance Today

As of recent reports, DCI Microfinance Limited employs between 51 to 200 professionals, with a revenue ranging from GHS 400 million to GHS 470 million. The company's dedication to understanding and supporting SMEs, coupled with its active involvement in community welfare, underscores its role as a significant player in Ghana's microfinance sector.